Introduction

70% of the world’s cocoa is grown in Africa, particularly in West Africa.

This project aims to gain insights into the recent increase in FORASTERO imports from Africa to Europe.

FORASTERO is a type of cocoa used in the cocoa and chocolate industries. Understanding these trends will be crucial for informing business decisions and strategies. Majority of the data used for this report is based on Cocoa exports from Africa.

That means a combination of all cocoa types exported from Africa and not just Forastero. However, Forastero variety dominates the cocoa market (it accounts for around 80% of the world’s cocoa production).

Overall Trend

- EXPORTS IN 2018-2022

The Top African Exporters of Cocoa Beans to Europe were Cote D’Ivore ($19.2B), Ghana ($7.5B), Nigeria ($3.0B), Cameroon ($2.5B) and Uganda ($400M)

- IMPORTS IN 2018-2022

The Top European importers of Cocoa Beans from Africa were Netherlands ($9.63B), Germany ($4.02B), Belgium ($3.38B), France ($1.68B), and Italy ($1.3B).

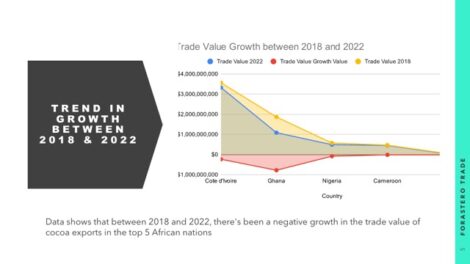

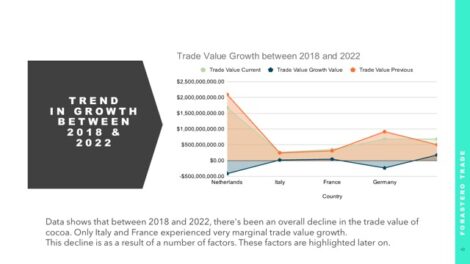

TRENDS IN GROWTH BETWEEN 2018 & 2022

A downward trend was identified in the production and therefore the availability of Cocoa by exporting nations.

The downward trend in cocoa production could potentially continue due to various factors such as climate change, aging cocoa trees, and socioeconomic challenges in cocoa-producing regions. Climate change poses a significant risk as rising temperatures and unpredictable weather patterns affect cocoa yields and quality. Aging cocoa trees also contribute to decreased productivity over time, requiring significant investment in replanting and rejuvenation efforts.

Socioeconomic challenges such as poverty among cocoa farmers and inadequate infrastructure further exacerbate the situation.

For African producers, the continuation of this downward trend presents both challenges and opportunities. Producers may face declining incomes and livelihoods, particularly if yields continue to decrease without corresponding price increases.

However this scenario could also incentivize innovation and investment in sustainable farming practices, technology adoption, and crop diversification.

African producers may also explore opportunities in value-added products and vertically integrated supply chains to capture more value from their cocoa production.

On the other hand, European buyers who are major consumers of cocoa products may face risks related to supply chain disruptions and price volatility.

A sustained decrease in cocoa production could lead to tighter supply conditions, potentially driving up prices and impacting profit margins for European chocolate manufacturers and retailers.

Coca prices broke $10,000 per ton for the first time in March 2024, amid disease outbreaks and destructive weather patterns in West Africa.

FACTORS ATTRIBUTING TO THE AFRICAN COCOA PRODUCTION

- Disease

Disease outbreaks in West Africa, especially the swollen shoot virus disease, have contributed to the decline in cocoa production. Insects also pose a huge threat.

Every year, an estimated 30-40% of the cocoa crop in West Africa is lost to pests and diseases.

- Weather

Droughts and other climate change-induced weather phenomena have also led to a decline in cocoa production.

- Socioeconomic

Cocoa farmers have not been fairly compensated for sustainable cocoa production, leading to a lack of investment in the sector.

Also issues like poverty among cocoa farmers, inadequate access to resources such as fertilizers and pesticides, and labor challenges can hinder productivity.

- Human factors

Human factors such as illegal mining, which has taken over many farms in Ghana, have also contributed to the decline in cocoa production. Encroachment of cocoa farms into forested areas, deforestation, and land degradation can reduce suitable land for cocoa cultivation.

- Aging Cocoa trees

Many Cocoa trees in these regions are old and require high maintenance costs, leading to a decline in production.

What is the impact on Africa ?

- Loss of Revenue

Cocoa is a major export for many African countries, and a decline in production means a loss of revenue from exports, impacting the overall economic growth of these nations.

- Increased import costs

European countries heavily reliant on Cocoa may face increased import costs due to decreased supply, leading to higher prices for customers and potentially affecting businesses that rely on Cocoa products.

- Socio economic benefits decline

Cocoa farming provides livelihood for millions of people in Africa. A decline in production could result in job losses and reduced income for farmers and communities dependent on Cocoa cultivation.

Many cocoa producing regions in Africa already face high levels of poverty. A decline in cocoa production could exacerbate poverty levels.

- Supply chain

European chocolate manufacturers and other businesses that rely on Cocoa imports from Africa may face supply chain disruptions due to decreased production.

This could lead to shortages of cocoa and higher prices for cocoa-based products in European markets.

- Market competition

If African cocoa production continues to decline, European countries may look to other regions to fulfill their cocoa needs.

South America, particularly countries like Brazil, Ecuador, and Colombia, and Southeast Asia, including countries like Indonesia and Malaysia, are significant cocoa producers.

CHANGES IN EUROPEAN IMPORT REGULATIONS OR INCENTIVES AFFECTING COCOA IMPORTS:

- Sustainability Standards

European regulations and consumer preferences increasingly prioritize sustainably sourced cocoa, leading to greater demand for certified cocoa products and incentivizing compliance with sustainability standards.

The regulations have caused exports of Cote d’ivore and Ghana to fall, relative to non-EU importing countries, by 34% and 47% respectively.

- Ethical Sourcing

Heightened awareness of issues such as child labor and deforestation in cocoa supply chains has prompted European regulations and industry initiatives to address these concerns, impacting sourcing practices and demand paterns.

- Tariffs and Trade policies

Changes in trade agreements, tariffs and import/export regulations can affect the cost and accessibility of cocoa imports into European markets, influencing demand dynamics

- Support Programs

Government incentives or support programs for promoting cocoa consumption, local processing, or sustainable sourcing practices can stimulate demand for cocoa products in European markets.

Analysis purpose

On the other hand, European buyers who are major consumers of cocoa products may face risks related to supply chain disruptions and price volatility.

A sustained decrease in cocoa production could lead to tighter supply conditions, potentially driving up prices and impacting profit margins for European chocolate manufacturers and retailers.

Cocoa prices broke $10,000 per ton for the first time in March 2024, amid disease outbreaks and destructive weather patterns in West Africa.

Future Possibilties.

- Nigeria, the world’s fourth largest cocoa producer and supplier saw the value of its global supply decline by 3.4 percent to 280,000 metric tones in the 2022-2023 season, according to the International Cocoa Organization’s latest data on global production (ICCO).

- The International Cocoa Organization (ICCO) projects this season’s global cocoa production will drop by 10.9% to 4.45m metric tons. The market will have a deficit of 374,000 tons this season, compared to a mismatch between supply and demand of 74,000 tons the previous season.

RECOMMENDATIONS FOR AFRICAN COCOA MARKET

If there’s a continuous and significant decline in cocoa production from African countries, it is possible that the European market could potentially shift to other supporting continents. This includes Sputh America (Brazil, Ecuador) or South-East Asia (e.g Indonesia, Vietnam).

This shift could occur for several reasons:

- European countries may establish or strengthen trade agreements and partnerships with cocoa-producing countries outside of Africa to ensure a stable supply of cocoa.

- European countries may seek to diversify their sources of cocoa to mitigate the risks associated with relying heavily on one region.

However, it is important to note that African countries currently dominate global cocoa production, and it may be challenging for other continents to fully replace Africa’s production capacity in the short term.

So what can be done to help the cocoa market of African countries.

HOW CAN EUROPEAN IMPORTERS ASSIST?

- Fair Trade Practices

Importers can commit to fair trade practices, ensuring that African cocoa producers receive fair prices for their products. This includes paying above market prices, providing access to credit, and establishing long-term contracts.

- Investments in infrastructure

Importers can invest in improving infrastructure in cocoa-producing regions of Africa. This can include building roads, warehouses, and processing facilities to help streamline the supply chain and reduce post-harvest losses.

- Advocacy and Lobbying

Importers can advocate for policies that support sustainable cocoa production and fair trade practices at the national and international levels. This can include lobbying for stricter regulations on child labor and deforestation in cocoa-producing countries.

- Research and Development

Importers can invest in research and development initiatives to improve cocoa farming techniques, develop new cocoa varieties and find solutions to challenges such as pests and diseases.

Leave a Reply